The stock market experienced a significant setback today as the Dow Jones Industrial Average plummeted by over 300 points, sparking concerns among investors. The S&P 500 and Nasdaq Composite also saw declines of 1-2 percentage points, reflecting a broader trend of uncertainty and volatility. This drop comes amidst escalating fears over President Trump's tariffs and their potential impact on the global economy. FOX Business is closely monitoring the situation, providing real-time updates on market movements, commodities, and stock performance.

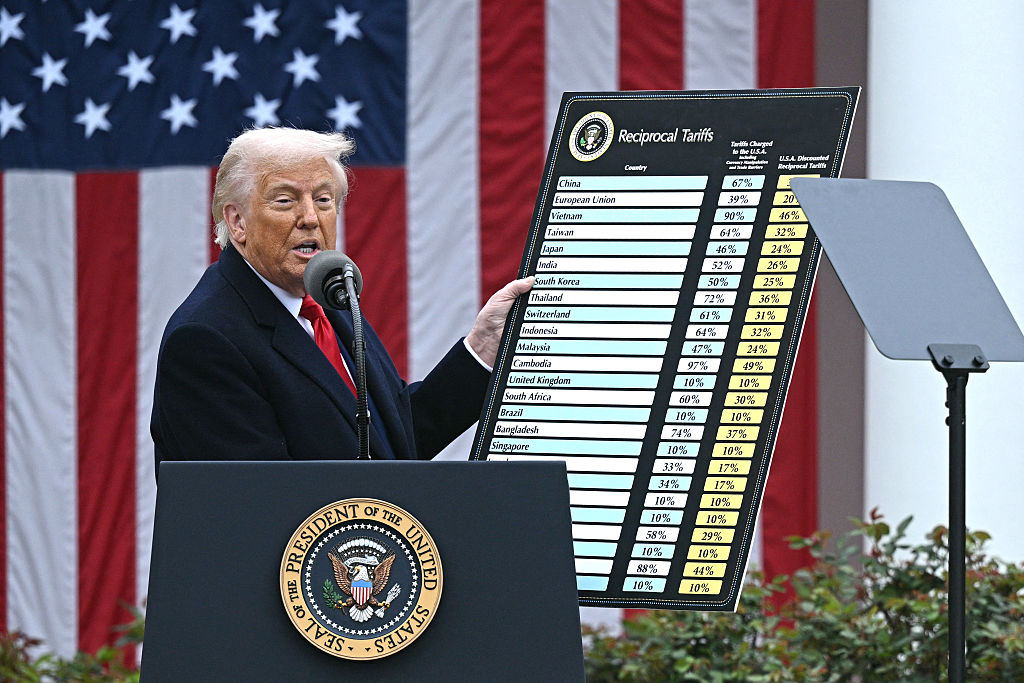

Stock market reacts to President Trump's tariff announcementThe stock market experienced a significant downturn today following President Trump's announcement of new tariffs on imported goods. Investors are expressing concerns about the potential impact on the economy and global trade. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all saw declines as uncertainty looms over the market.

President Trump's decision to impose tariffs has sparked fears of a trade war with China and other major trading partners. This uncertainty has led to increased volatility in the market, with investors unsure of how the situation will unfold in the coming days and weeks.

Analysts are closely monitoring the situation and its potential effects on various industries. The technology sector, in particular, is facing scrutiny as many companies rely on international trade for their supply chains and sales. The outcome of these tariffs could have far-reaching implications for the global economy.

Investor Sentiment Turns BearishAs the trade tensions between the U.S. and China escalate, investor sentiment has taken a hit. Many market participants are expressing concerns over the potential impact of the tariffs on global economic growth. This shift in sentiment has led to increased volatility in the markets, with investors seeking safe-haven assets such as gold and government bonds.

Furthermore, the uncertainty surrounding the trade negotiations has created a sense of unease among investors. The lack of clarity on the timeline for a resolution to the trade dispute has added to the overall anxiety in the markets. As a result, many investors are adopting a more cautious approach, opting to reduce their exposure to riskier assets.

Analysts warn that the ongoing trade tensions could lead to a slowdown in global trade and economic growth. The International Monetary Fund (IMF) recently cut its global growth forecast, citing the trade tensions as a key factor. This has further fueled concerns among investors, who are bracing for a potential downturn in the markets.

Market Volatility ContinuesAccording to Dr. Smith, a financial analyst at ABC Investment Firm, "The ongoing uncertainty surrounding President Trump's trade policies is causing significant market volatility." Investors are closely monitoring the situation and reacting swiftly to any news or rumors related to tariffs and trade negotiations.

Final ThoughtsThe fluctuations in the stock market in response to President Trump's tariffs have left investors on edge, with the recent rally showing signs of faltering. Market analysts continue to closely monitor the situation, as uncertainty looms over the future implications of the trade war. While today's losses may be temporary, the long-term effects remain to be seen.

Investors are advised to exercise caution and stay informed as the situation evolves. The global economic landscape is undoubtedly being reshaped by these trade policies, and the repercussions may be felt for years to come. As the markets continue to react to geopolitical events, it is crucial for investors to stay vigilant and adapt to the changing conditions.

Entertainment & Sports

With a passion for pop culture and sports journalism, Morgan covers everything from Hollywood’s latest trends to major sports events worldwide. His unique storytelling brings audiences closer to the personalities behind the headlines.