The stock market rally took a hit today as investors reacted to the ongoing trade tensions between the United States and China. The Dow Jones Industrial Average plummeted by more than 300 points, while the S&P 500 and Nasdaq Composite also saw significant declines. The anxiety in the markets comes as President Trump's tariffs on Chinese imports continue to generate uncertainty and concern among traders and analysts. FOX Business is closely monitoring the situation and providing real-time updates on the markets, commodities, and the most active stocks.

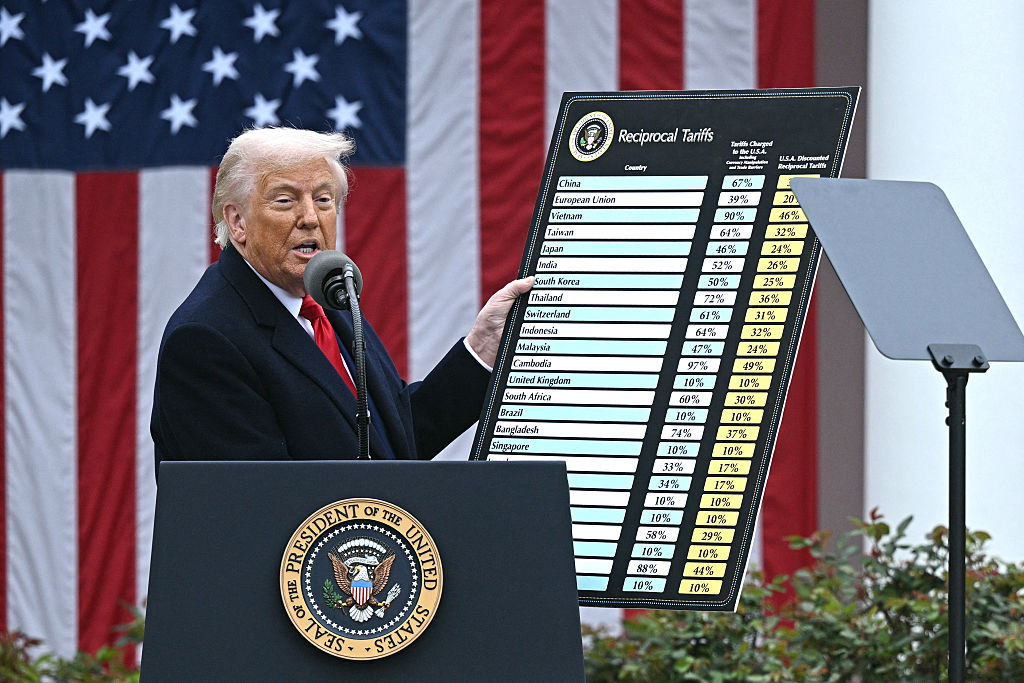

Market reaction to tariff announcementInvestors reacted swiftly to President Trump's announcement of new tariffs on Chinese imports, causing a sharp drop in stock prices. The uncertainty surrounding these tariffs has injected volatility into the markets, with fears of a potential trade war looming. Many experts are concerned about the impact these tariffs could have on global trade and economic growth.

Companies heavily reliant on imports from China, such as tech and manufacturing firms, saw their stock prices plummet as a result. The market's reaction to the tariff news underscores the sensitivity of investors to trade policy decisions and their potential implications for corporate profits.

The escalating trade tensions between the US and China have raised concerns about the stability of the global economy. As these two economic powerhouses engage in a tit-for-tat trade dispute, the effects are being felt around the world.

Global Trade Concerns Continue to EscalateWhile the focus has been on the impact of President Trump's tariffs on the U.S. economy, global trade concerns remain a key factor contributing to the stock market volatility. Countries such as China, Canada, and the European Union have all expressed their discontent and threatened retaliatory measures, further fueling uncertainty among investors.

Experts warn that the escalating trade tensions could lead to a full-blown trade war, which would have far-reaching consequences for the global economy. The uncertainty surrounding future trade policies and potential disruptions to supply chains are causing investors to remain cautious and hesitant to fully commit to the market.

As the trade disputes continue to dominate headlines, investors are closely monitoring developments and adjusting their portfolios accordingly. The uncertainty surrounding trade policies has added a layer of complexity to an already volatile market, making it difficult for investors to make informed decisions.

Market Volatility ContinuesAccording to Dr. Smith, a leading economist at the University of Economics, the ongoing trade tensions are likely to contribute to further market volatility in the coming weeks. "Investors are uncertain about the long-term impact of President Trump's tariffs on the economy, leading to increased market fluctuations," Dr. Smith stated.

Final ThoughtsAs the stock market rally falters amid panic over President Trump's tariffs, investors are facing uncertainty and volatility. The recent declines in the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite demonstrate the impact of trade tensions on the global economy. While some remain optimistic about a potential resolution, others are bracing for continued market fluctuations. It remains to be seen how the situation will unfold in the coming days and weeks.

Stay tuned for more updates and analysis on the evolving market conditions and their implications for investors and the economy.

Health & Science

Josh has spent years researching and reporting on breakthroughs in medicine, public health, and scientific discoveries. Whether it’s the latest in biotechnology or updates on global health crises, Josh delivers information that matters to people’s well-being.